On average, it costs about $27.70 per month or $332 annually to insure an adult cat in the United States.

Pet insurance premiums are highest for older cats, especially those insured later in life, and those living in expensive zip codes. You can lower that premium by adjusting pet insurance policy. Leaner pet insurance coverage, higher deductibles, lower annual payout caps, and lower reimbursement percentages all translate to paying less month-over-month.

Is Pet Insurance for Cats Worth It?

I asked veterinarians for their opinion, and the answer was a resounding “yes”. Dr. Jennifer Coates, who serves on the advisory board for Pets Digest, proposes a simple question to determine whether or not you need pet insurance. She encourages you to “Ask yourself if you could cover all the costs associated with a major pet illness or injury right now. If the answer is ‘no,’ pet insurance could literally save your pet’s life.”

With emergency veterinary bills in the thousands or higher, knowing you can afford to save your cat’s life could make pet insurance worth it.

But insurance is always a gamble, and the average cat owner will spend more on insurance than they’ll save. You’ll typically have to pay $5,000 or more on your cat’s healthcare throughout their lifetime to start seeing benefits—and that doesn’t include routine care like checkups and vaccinations.

So is it worth it for you? Read on to get a full pricing breakdown and learn if pet insurance is right for you and your cat.

Why Should You Trust Us?

At Cats.com, we’ve put hundreds of hours into pet insurance research. We’ve published guides on the best pet insurance in the United States, Canada, and the UK, along with several reviews of specific providers.

Since writing the original version of Cats.com’ guide to the best insurance providers a couple of years ago, I’ve spent uncounted hours getting quotes, analyzing coverage, talking with insurance companies, and reviewing various providers.

To write this article, I spent over 25 hours studying what insurance companies consider when pricing their coverage. I generated over 100 unique quotes and compared prices across different age groups, locations, genders, and more.

Cost of Pet Insurance for Cats by Age & Provider

After gathering 108 quotes from 12 different providers, I found that monthly pet insurance premiums ranged from as little as $12 or less for kittens in cheaper areas to over $258 per month for geriatric cats in pricey areas.

| 6 Months | 1 Year | 5 Years | 10 Years | 15 Years | |

| Lemonade | $12.00 | $12.17 | $13.58 | $28.83 | Not eligible |

| PetsBest | $14.63 | $14.63 | $16.46 | $31.20 | $68.05 |

| Healthy Paws | $15.40 | $15.40 | $20.10 | $45.10 | Not eligible |

| Embrace | $22.53 | $22.53 | $22.53 | $47.19 | $14.78 (accident-only) |

| ASPCA | $29.77 | $29.77 | $33.45 | $76.82 | $135.18 |

| Petco Insurance | $29.77 | $29.77 | $33.45 | $76.82 | $135.18 |

| Trupanion | $34.93 | $34.93 | $46.39 | $106.95 | Not eligible |

| Nationwide | $12.01 | $12.01 | $15.01 | $71.40 | $110.34 |

| Pumpkin | $32.12 | $32.12 | $36.09 | $82.89 | $145.87 |

| Figo | $19.21 | $19.57 | $22.99 | $37.96 | $76.53 |

| Prudent Pet | $27.95 | $27.95 | $31.30 | $69.41 | $105.65 |

| Fetch | $25.62 | $25.84 | $40.82 | $96.99 | $258.31 |

All values are based on a male domestic shorthair cat living in Knoxville, Tennessee, and the provider’s most popular or recommended plan (average plan included a $10,000 annual payout limit, $250 deductible, and 80% reimbursement).

How Much Pet Insurance Costs for a Cat Depends on Several Factors

When you’re choosing pet insurance, several factors will determine both your monthly premiums and your savings at the vet.

Some are things you can’t control—the cost of living in your area, the age of your cat, their breed, and any existing health issues.

Other factors are within your control. You can adjust your policy to raise or lower premiums in exchange for more or less coverage. In general, the more you’re saving at the vet, the more you’re spending each month.

If you have a little extra money saved and are willing to take the risk, opt for less coverage to save on those monthly bills. If you have less saved and are willing to spend a few extra dollars each month for more protection in an emergency, beef up your policy and spend more every month.

Coverage Type

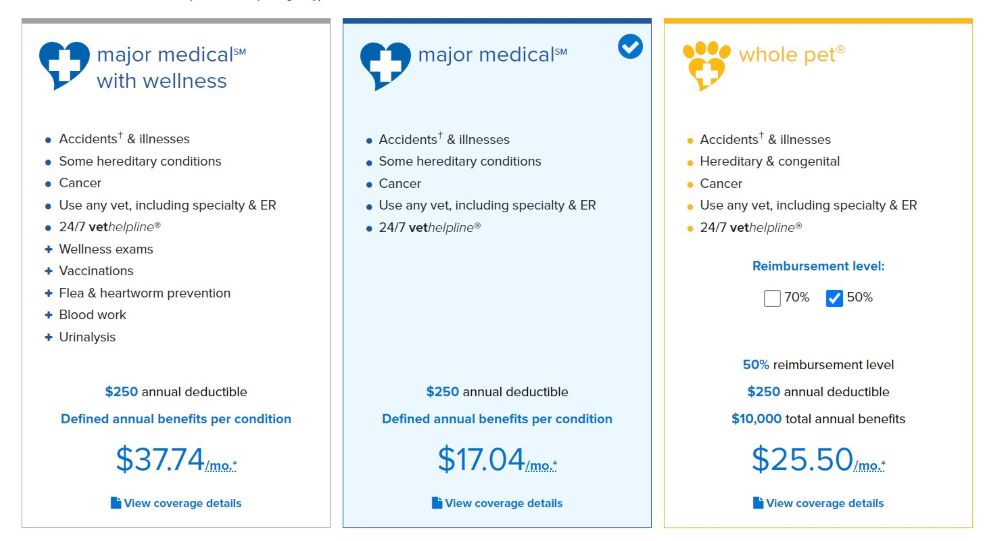

Nationwide, shown here, offers three policy options. Choose from a standard accident and illness plan with no preventative care, a plan with a wellness add-on, or an enhanced accident and illness plan with adjustable benefits.

Pet insurance policies come in two flavors—accident and illness plans and wellness plans.

Usually offered as the default when you sign up, accident and illness plans cover unexpected bills for things like poisoning, injuries, and diseases. You’ll usually have a deductible, reimbursement rate, and annual deductible.

Wellness plans are usually tacked on to accident and illness plans and will cover your routine care expenses like exams, dental cleanings, vaccines, bloodwork, and medications unrelated to an accident or illness. Most don’t have any deductible, so you can start getting coverage as soon as your plan is active. Limits are either annual or on a per-procedure basis.

Deciding which kind of coverage is right for you can be tricky—a wellness plan covers expenses that most people will encounter year after year, but you’re almost guaranteed to lose money on it unless you’re normally spending over $120 per year on this type of routine care.

Wellness plans are best for those who go in for multiple wellness visits each year, who just adopted a kitten, and cats who get dental cleanings every year.

Consider activating or deactivating your wellness add-on depending on your needs that year.

Deductible

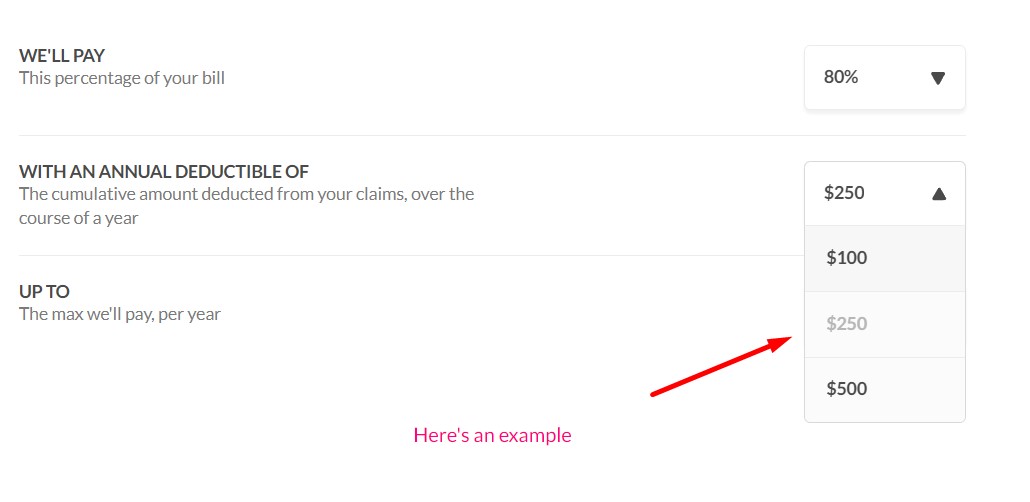

Annual deductibles usually range from $100 to $500, and providers usually allow you to adjust your deductible to lock in the best premium. Lemonade, shown here, offers three deductible options.

The deductible is the amount you pay before the pet insurance provider will reimburse you.

If you have a $250 deductible, you’ll have to spend $250—either in one bill or over multiple visits—before the insurance will kick in. Once you’ve hit that deductible, the insurance company will reimburse you for everything afterward. For example, before you’ve reached your deductible, a $150 procedure will come out of your pocket. Spend $100 more, and the company will start covering subsequent bills.

If you have an annual deductible—the most common pet insurance deductible type—this will reset each year, and you’ll have to hit that deductible again before getting paid. If you have a per-condition deductible, you’ll have to reach that number for a single condition before the insurance company pays for anything. After you’ve reached the deductible amount on a particular condition, the medical bills related to that condition are covered for life with no renewing deductibles.

Most pet insurance companies allow you to choose from several annual deductibles, usually ranging from $100 to $500. A higher deductible saves you money on monthly premiums, but it also means you’ll have to spend more before you can start getting money back at the vet.

In general, high deductibles are a good choice for people with some money saved for unexpected vet bills, who don’t go to the vet very often, and who are willing to take a bit more risk to save in the long term. Lower deductibles are the right choice if you don’t have enough savings to cover an unexpected bill and would rather spend a little extra each month to play it safe.

Reimbursement Rate

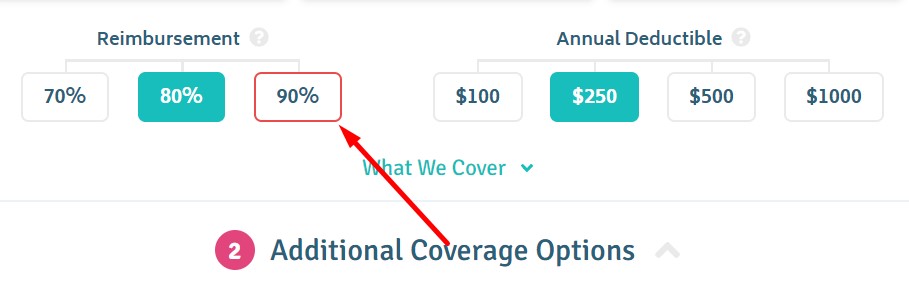

Insurance providers usually let you choose a reimbursement rate ranging between 50% and 100%. Prudent Pet, shown here, gives three reimbursement options.

Unlike health insurance for people, most pet insurance providers reimburse you after you’ve paid for your cat’s vet bill. While some cover 100% of the bill, most providers cover a percentage of the bill rather than its entirety—the typical percentage covered ranges between 70% and 90%.

Lower reimbursement rates translate to lower monthly premiums, but you’ll have to pay more at the vet. A low reimbursement rate is a higher-risk choice that saves you money every month. If you have some money saved to cover unexpected bills and just want to offset huge bills, a lower reimbursement rate combined with a high deductible may be the right choice.

Annual Limits

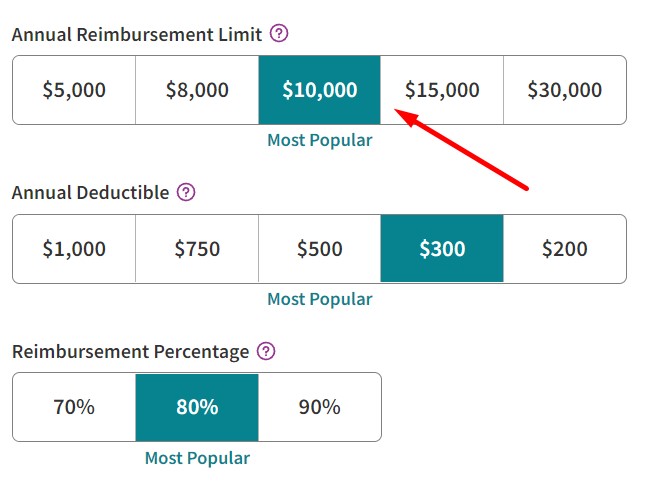

Most pet insurance providers allow you to choose from several annual limits. Embrace, shown here, offers five options ranging from $5,000 per year to $30,000 per year.

Your annual limit is the amount of money that the insurance company is willing to pay out each year. After you reach that limit, all subsequent vet bills are your responsibility until the policy period ends. Providers allow you to choose unlimited payouts or an annual limit, typically ranging from $5,000 to $20,000.

A lower annual limit means that you’ll spend less per month, but there’s a greater chance that you’ll be on the hook for big bills. Higher annual limits cost more each month but provide some security when bills add up into the tens of thousands.

Remember that these limits don’t roll over. If you were $5,000 below your coverage limit last year, that amount will not be added to this year’s budget.

When deciding on which limit is right for you, consider your cat’s age, personality, and how much you spent on vet care last year. For most cats, an unlimited or very high annual benefit is not necessary. Veterinary costs seldom reach over $5,000 in a single year.

While you usually can’t change pet insurance mid-term—before your policy renews for the year—consider getting a lower annual benefit when your cat is young and healthy and upgrading to a higher limit as they age.

Age, Breed, and Gender

Because older cats are more illness-prone than younger ones, your cat’s age is one of the biggest things affecting how much their insurance costs month-to-month.

Age

Young cats and kittens have lower premiums than senior cats, and most insurance providers increase your cat’s rate as they age. Insurance premiums are highest if your cat opens their first policy when they’re getting up in years.

Breed

Certain breeds, like Bengals and their predisposition to hypertrophic cardiomyopathy (HCM), are more prone to health issues that could send them to the vet. While there aren’t any breed exclusions in cat insurance, companies will ask about your cat’s breed and adjust your monthly premium accordingly.

Gender

Gender also makes a difference. Compared to female cats, males are slightly more expensive to insure. For example, it would cost a 5-year-old male cat from Atherton, California $34.20 per month to get insured through Figo. The company would charge his sister a $27.85 premium for the same coverage.

Where You Live

Your cat’s insurance premium will cost more or less depending on where you live, how much veterinary bills cost in your area, and other factors.

The state you live in seems to be the biggest determinant, with premiums in New York—the most expensive state for pet insurance—costing 30% more than the national average. Meanwhile, the cheapest plans, sold to cats in Louisiana, cost 28% less.

Discounts

Most insurance companies provide discounts for multi-pet homes, and you’ll also find discounts available for special cases. You may be able to get a percentage off of your monthly premium if you adopted your pet from a shelter or work at one, have a support or therapy pet, or are an active or former member of the military. Check to find out if you’re eligible for any additional discounts before activating a new policy.

So, Is Pet Insurance for Cats Worth It?

While it’s likely that you’ll end up spending more on pet insurance than you would on veterinary care, insurance gives peace of mind when huge bills roll in.

On average, pet insurance becomes worth it if you’re spending $4,980 over the course of your cat’s lifetime. Of course, there’s no way of knowing if or when your cat will encounter a health problem that costs thousands in treatment, and insurance is best bought early. It’s a gamble in most cases, but so is going without.

Assuming you open a policy within their first year, the average cat’s pet insurance will cost around $5,000 over the course of a 15-year lifetime (based on 2022 prices).

The ASPCA’s 2021 estimates put the average owner’s veterinary spending at $160 per year. Add one emergency—urethral blockage, for instance—and that lifetime vet cost goes up by $1,500. If your cat develops diabetes, insulin injections might set you back $180 to $540 each year.

With one emergency and three years of a health issue requiring regular treatment on top of routine care, that’s $4,400 over 15 years—about $600 less than the lifetime cost of insurance premiums. Remember that a standard accident and illness policy won’t cover routine care, anyway, so you’d still be paying for that out of your pocket.

Of course, big bills do happen, and you may run into an exceptionally hefty bill of $5,000 or more. In its list of their most expensive claims, Southern Cross Pet insurance mentions an $11,902 bill for traumatic skin injury and skin disease in a 2-year-old cat and a $9,471 treatment for lower urinary tract disease and skin infections in a 1-year-old Devon Rex.

The biggest payoffs of pet insurance come from emergencies and long-term illnesses, which can quickly add up to thousands of dollars. The best approach is to act early and get your cat insured when they’re young and no pre-existing conditions have shown up in their records.

Pet Insurance Isn’t Right for Every Cat.

Many cats have already received treatment for long-term conditions by the time they reach middle age, and the more time your cat has spent in a vet’s office, the more likely it is that your claim will be denied.

If your top priority is paying for something like already-diagnosed chronic kidney disease or diabetes, pet insurance can’t help you. Alternative services, like Pet Assure’s discount club, might be a better choice.

Is Pet Insurance Worth It for Cats With FIV?

Remember that cats with FIV are more likely to get sick, and your insurer will consider any related illnesses a pre-existing condition. Since pet insurance doesn’t cover pre-existing conditions, all claims will be denied. If you open a policy before your cat is diagnosed, you will be able to get coverage for related treatment.

Is Pet Insurance Worth It for Indoor Cats?

Pet insurance can be a good choice for indoor cats. Cats who live indoors can develop serious health issues like urethral blockages, poisoning, cancer, and more—and those come with hefty bills that make pet insurance a great choice.

Is Pet Insurance Worth It for Senior Cats?

It depends on whether or not your cat has been diagnosed with health issues. If your cat has a lot of pre-existing conditions that still affect them today, they may run into so many denied claims that pet insurance simply isn’t worth it anymore.

Your premium will be significantly higher than it would be for a younger cat, too, so it might make more sense to put aside as much of a savings account as you can. If your cat is a senior and doesn’t have any existing health issues, though, pet insurance can be a good investment to help with common late-life health concerns.

Frequently Asked Questions

How does cat insurance work?

In most respects, cat insurance works like any other insurance. You pay a monthly premium in exchange for money paid out when you need it. Like other insurance, you’ll have to meet a certain deductible before you’ll get anything, and premiums vary depending on the amount of your deductible.

While human health insurance is usually paid directly to your healthcare provider, most pet insurance companies reimburse you after you’ve paid the vet. While some offer 100% reimbursements, pet insurance typically pays a percentage of the bill, not its entirety.

Pet insurance will not cover pre-existing conditions, and not every plan covers the same things. Different tiers and plan types exist to ensure that your cat gets the coverage you want—read the policy thoroughly to determine which one is right for you.

What to look for in cat insurance?

When choosing a cat insurance provider, look for a company with a strong reputation and financial stability. Some newer companies will offer low premiums to new customers and sharply increase rates as they mature. Look for a strong value—the best pet insurance offers comprehensive coverage for accidents and illness treatment with minimal exclusions. Wellness plans are usually not necessary, but if you choose one, select the one that offers the most essential coverage at a price you can afford.

Does cat insurance cover vaccinations?

Because vaccines are considered routine care, most standard accident and illness policies will not cover them. However, a wellness plan—usually tacked on to your core policy as an optional add-on—will usually cover vaccinations. Be sure to check the policy to find out how many vaccinations are covered during one policy term.

Does cat insurance cover neutering?

A basic cat insurance plan will not cover spay and neuter surgery, as it is considered an elective procedure. However, wellness add-ons will usually cover this procedure.

Does cat insurance cover dental?

Standard cat insurance policies will cover dental accidents and injuries, but you’ll usually have to opt for a wellness add-on to get coverage for routine cleanings and check-ups.

Why are male cats more expensive to insure?

Male cats are more expensive to insure due to a statistically higher risk of health issues, including both accidents and illnesses. Insurance companies pay out more claims for male cats, so they make up for it with higher premiums. Pet insurance companies don’t consider spay/neuter status or whether the cat lives indoors or outside, so a neutered male who lives indoors is considered just as much a liability as a rough-and-tumble tom who lives outside.

On average, it costs about $27.70 per month or $332 annually to

On average, it costs about $27.70 per month or $332 annually to